The Sri Lankan economy has experienced positive signs of economic recovery and a measure of stability in macro-economic factors compared to the previous period, with the appreciation of LKR against USD and the IMF bailout followed by the Domestic Debt Optimization (DDO) announcement.

However, the Banking industry faced many challenges in managing the quality of the loan book while having high impairment charges which created pressure on the profitability and capital adequacy requirements over the last two years.

The fluid government regulations and monetary policy of Central Bank of Sri Lanka (CBSL) aim to enable the economy to reach its potential and stabilize inflation at mid-single digit levels in the medium term, while easing pressures in the financial markets.

Accordingly, CBSL decided to reduce the policy interest rates which will provide the impetus for market interest rates to adjust downwards.

The Bank will align to these positive market trendsby providing further assistance to customers in order to recover from the existing situation.

The following commentary relates to the unaudited Financial Statements for the period ended 30 June 2023, presented in accordance with Sri Lanka Accounting Standard 34 (LKAS 34) on “Interim Financial Statements”.

Financial Performance

Profitability

DFCC Bank PLC, the largest entity within the Group, reported a Profit Before Tax (PBT) of LKR 5,110Mn and a Profit After Tax (PAT) of LKR 3,205Mn for the period ended 30 June 2023.

This compares with a PBT of LKR 331Mn and a PAT of LKR 513Mn in 1H of 2022.

The Group recorded a PBT of LKR 5,867Mn and PAT of LKR 3,923Mn for the period ended 30 June 2023 compared to LKR 690Mn and LKR 824Mn, respectively, in 2022.

All the member entities of the Group made positive contributions to this performance.

The Bank’s Return on Equity (ROE) increased to 10.52% during the period ended 30 June 2023 from 5.04% recorded for the year ended 31 December 2022.

The Bank’s Return on Assets (ROA) before tax for the period ended 30 June 2023 is 1.62% compared to 0.46% for the year ended 31 December 2022.

Net Interest Income

The Bank's Net Interest Income (NII) increased 41% over Q2 of 2022 to reach LKR 15,475 Mn by the end of June 2023.

Both deposit and lending interest rates have continued to adjust downwards with the market guidance provided by the Central Bank, along with improvement in liquidity conditions of the domestic money market.

While lower interest rates may have resulted in reduced interest income and expenses, in nominal terms,Net Interest Income (NII) has continued to improve as a metric during the period under review, as a result of the time lag in repricing existing deposits and the lending portfolio, and due to the Bank's strategy of investing in high-yield government securities.

Strategically, the Bank thus increased its fixed-income investment portfolio, contributing significantly to increased interest income.

The interest margin increased from 4.43% in June 2022 to 5.48% by June 2023.

Fee and Commission Income

The Bank’s dynamic strategies and the efforts of its dedicated teams led to increased remittances, trade-related commissions, and other fee income lines, which contributed to the increase in non-funded business during the period.

Fee income generated by credit cards also increased significantly, in line with the volume of the transactions.

Accordingly, net fee and commission income have increased by 64% to LKR 1,945 Mnfor the period ended 30 June 2023, compared to LKR 1,183Mnfor the comparative period in 2022.

Impairment Charge on Loans and Other Losses

The impaired loan (stage 3) ratio increased from 4.36% in December 2022 to 5.58% as of 30 June 2023, a continuation of the prevalent trend amidst the present economic conditions.

However, the Bank expects this trend to moderate and potentially improve towards the end of the year, reflecting positive developments in the macroeconomic environment,coupled with the Bank’s concerted efforts with regard to recoveries.

To address the current and potential future impacts of the present economic conditions on the lending portfolio, the Bank made adequate impairment provisions during the period by introducing changes to internal models to account for unseen risk factors in the present highly uncertain and volatile environmentincluding additional provisionsmade for the Bank’s exposure to risk elevated sectors.

The Bank has used significant judgement using the information available as at reporting date to estimate the recoverable value of foreign currency denominated investment securities issued by Government of Sri Lanka.

Accordingly, an impairment charge has been recognized to maintain a provision cover of 42% on above investments.

Accordingly, with these provisions made to address the additional risks in the economic environment, the impairment charge recorded an increase of 19% against the comparative period, thus standing at LKR 8,096 Mn, for the period ended 30 June 2023, compared to LKR 6,808 Mn in the comparable period.

Operating Expenses

Operating expenses for the period ended30 June 2023 rose primarily due to the increase in inflation.

However, the Bank has taken numerous cost control measures within the Bank, resulting in operating expenses being curtailed and managed at these levels.

Other Comprehensive Income

Changes in fair value of investments in equity securities and fixed income securities (treasury bills and bonds) and movement in hedging reserves are recorded through other comprehensive income.

Due to the application of hedge accounting, the impact on the total equity of the Bank due to exchange rate fluctuation was minimized.

A fair value gain of LKR 2,759Mn was recorded on account of equity securities outstanding as at 30 June 2023.

The increase in the share price of Commercial Bank of Ceylon PLC during the period was the main contributor to the reported fair value gain in equity securities.

The favourable movement in treasury bill and bond yields also resulted in a fair value gain of LKR 2,344Mn during the period.

Business Growth

Assets

Despite the challenges faced by the economy and the banking sector, DFCC Bank’s total assets increased by LKR 8.1Bn, recording a growth of 1.42% from December 2022.

In line with the bank's growth strategy and the present economic climate, an increase in investment in fixed income securities, combined with positive fair value movement in both fixed income securities and equity securities, has contributed to a 91% increase in investment in financial assets at fair value through other comprehensive income as of 30June 2023 compared to the balance as of 31 December 2022.

With increased provision for expected credit losses, appreciation of the Sri Lanka Rupee compared to 31 December 2022 and considerable economic challenges, the net loan portfolio was recorded at LKR 342Bn as at 30June 2023, which is 7% lower than the balance as at 31 December 2022.

Liabilities

The Bank’s deposit base experienced a growth of 3.21% during the period, recording an increase of LKR 11.9Bnto LKR 382Bn, up from LKR 370Bn as at 31 December 2022.

This resulted in recording a loan-to-deposit ratio of 100.39%. Further, the CASA ratio was 19.75% as at 30June 2023.

The Bank's funding costs were also contained using medium to long-term concessionary credit lines,primarily used to grow the lending portfolio.

Taking into consideration these concessionary term borrowings, the CASA ratio further improved to 30.76% and the loans-to-deposit ratio improved to 89.60% as at 30 June 2023.

Equity and Compliance with Capital Requirements

DFCC Bank’s total equity increased to LKR 59Bn as at 30 June 2023,supported by favourablemovements in the equity portfolio and fixed income security portfolio classified as fair value through other comprehensive income, and positive movements in the hedging reserve, together with therecorded profit after tax of LKR 3.2 Bn.

Accordingly, Tier 1 and Total Capital ratios recorded 10.085% and 13.148%, respectively as at 31 December 2022 improved to11.416% and 14.085%, respectivelyby 30 June 2023.

The Bank’s Net Stable Funding Ratio (NSFR) was 131.77%, and Liquidity Coverage Ratio (LCR) – all currency – was 305.06% as at 30 June 2023 compared to 126.55% and 202.34% respectively as at 31 December 2022. All these ratios were thus maintained well above the minimum regulatory requirement.

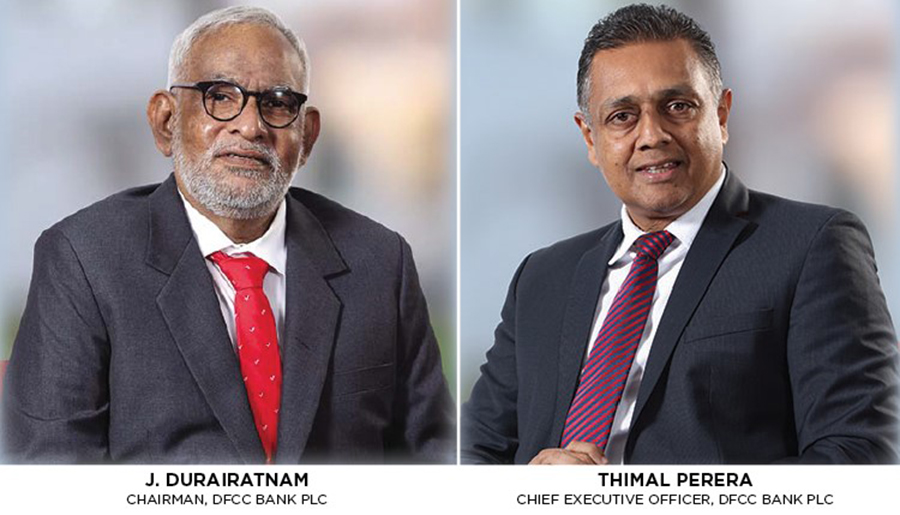

CEO’s Statement

"As we reflect on our performance in the first half of 2023,DFCC Bank PLC is pleased to report strong financial results across all business areas.

Sri Lanka's resilient and adaptable economy and our commitment to innovation, operational excellence, and customer-centricity continue to pay off, as evidenced by our steady revenue growth and increased profitability.

We are confident that our robust growth strategy and prudent risk management practices will enable us to continue delivering sustainable value to our stakeholders in the long term, helping to support Sri Lanka’s economy as it enters into a period of significant recovery, supported by strong macroeconomic fundamentals."