The Company has stood firmly with its policyholders in the face of the pandemic paying COVID claims of Rs 247 million for the period.

During the period in review, Softlogic Life’s market share is estimated at 16.3%, in comparison to 15.2% as of 31 December 2020.

The market share increase continues to rank Softlogic Life as the third-largest in the life insurance market, overtaking much older players to establish strong growth momentum.

Compared to the estimated Industry GWP growth, which was 30% during the first six months of 2021, Softlogic Life recorded GWP growth of 43%.

The company reported a 10-year Compound Annual Growth Rate (CAGR) of 29% of GWP, while the industry 10-year GWP CAGR growth was at 13%.

Softlogic Life also notes that its contribution to increasing insurance penetration in the country has increased during the period in review with 130,613 policies issued, insuring more than 1.5 million Sri Lankan lives.

Profit after tax (PAT) for the period in review rose to Rs. 920 million, an increase of 73% YoY.

The PAT includes Rs. 232 million one off deferred tax asset reversal due to the tax rate change from 28% to 24%.

Excluding this one-off item, the Company recorded regular PAT of 1,152 million.

Profit before tax (PBT) grew by 91% compared to last year at Rs. 1,454 million.

The company’s operating expense ratio decreased to 20%, where it stood at 27% a year ago due to prudent and efficient expense management initiatives adopted.

Furthermore, Softlogic Life maintained a healthy Capital Adequecy Ratio (CAR)of 298%, well above the regulatory CAR requirement of 120%.

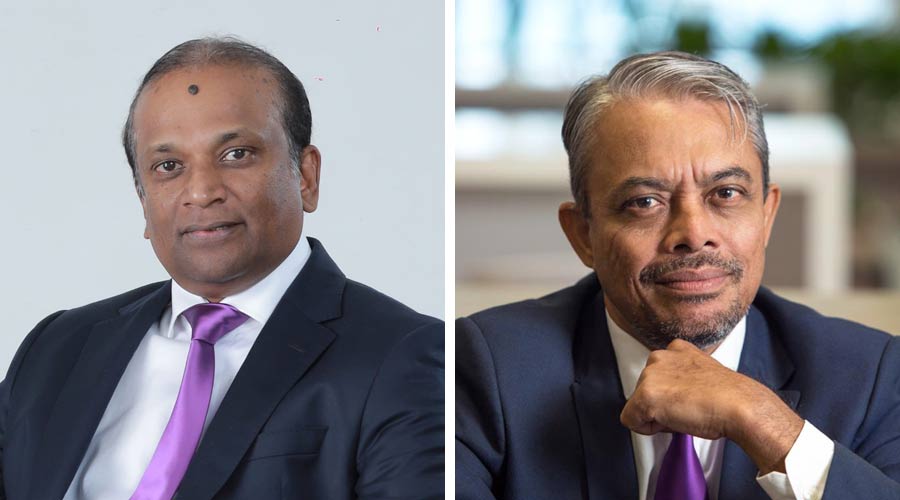

Commenting on the financial performance of the Company, Ashok Pathirage, Chairman of Softlogic Life Insurance PLC, stated,

“Despite numerous challenges posed by the ongoing pandemic, we have performed well to maintain our position as the third-largest life insurance company in Sri Lanka, growing our market share further to 16.3% by the end of the second quarter.

These accomplishments were facilitated by the strategies we deployed and the strong execution of those strategies that have enabled the Company to sustain momentum in spite of the prevailing macro challenges.”

Iftikar Ahamed, Managing Director of Softlogic Life PLC, commented,

“The pandemic has been a true test for Softlogic Life for us to showcase resilience and the effectiveness of our stategies, responsiveness and innovation.

Our process reengineering efforts backed by digital technologies to ensure overall efficiency and business continuity continue to help the company outdo each quarter and drive strong performance even during this quarter.

But most importantly our commitment to honour the promise of paying every fair claim through technologies such as our “One Minute Claims Initiative” and finding innovative product propositions to support Sri Lankans across different economic backgrounds to be able to afford insurance has enabled us to win the trust of over 1.5 Mn Sri Lankans.

As an life insurer we have paid out Rs. 2,618 million claims including settlement of COVID 19 claims of Rs. 247 million in the first six months of the year, which is a true testimony to the fact that we are always there for our customers.

We are proud that the company has remained resilient in the face of difficulties, and are confident of the measures we have taken to grow our business further in the coming months.”

Softlogic Life Insurance PLC is a subsidiary of Softlogic Capital PLC and is part of the Softlogic Group, which is recognised as one of Sri Lanka’s most diversified and fastest-growing conglomerates with interests in Healthcare, Retail, ICT, Leisure, Automobiles and Financial Services.

Significant stakeholders in the company include global investors Leapfrog Investments.

Businesscafe Image Left to Right Softlogic Life PLC Chairman Ashok Pathirage and Softlogic Life PLC Managing Director Iftikar Ahamed