The Bank’s Net Interest Income grew by 14.76% to LKR 17,068 Mn during the period under review, announcing a robust growth as the industry overcomes the prolonged impact of the pandemic.

The Bank reported a credit growth of 8.75 % increasing the advances from Rs. 394 Bn to Rs. 428 Bn.

This is mainly due to increase in term loans, revolving import loans, pawning and leases which was partly set off by decrease in refinance loans and export bills etc.

Further, the Bank’s asset base expanded by Rs 26,047 Mn to Rs 583,755 Mn.

Seylan Bank’s deposit base grew from Rs. 440 Bn to Rs. 451 Bn during the nine months ended 30th September 2021.

The overall Current Account Savings Account (CASA) balances increased by 7.45% during the period under review and the CASA ratio stood at 34.61 %.

Seylan recorded a noteworthy growth of 24.89 % in net fees and commission income for the period under review.

The growth was mainly attributed to fee income from guarantees and trade finance activities.

Net gains from de-recognition of financial assets, net gains on foreign exchange transactions and other operating income, came together to deliver a net gain of Rs. 1,979 Mn in 3Q 2021 mainly as a result of upward movement in exchange income despite the loss in Mark to Market on Derivatives Financial Instruments and drop in net capital gains on treasury bills and bonds.

Total expenses in the period increased by 5.42% to Rs. 10,036 Mn, as the Bank focused on embracing digital technology and process re-engineering, to achieve leaner and efficient processes while keeping the cost under control.

Meanwhile both interest income and interest expenses declined year-on-year, reflecting the reduced interest rate environment, with the latter posting a larger decline at 29.62% aided by the growth in Current Account Savings Account (CASA) balances.

Seylan Bank recorded 10.56 % as Total Tier 1 Capital Ratio and 13.87 % as the Total Capital Ratio.

The Gross NPA (Net of IIS) Ratio stood at 6.42 % as at 30th September 2021.

The Bank’s Earning per Share (EPS) improved to Rs. 6.00 from Rs 4.16 in Q3 2020.

The Bank recorded a Return (Profit Before Tax) on Average Assets (ROAA) of 1.04 % and Return on Equity (ROE) of 8.61%.

The Bank’s Net Assets Value per share as at 30th September 2021 was Rs. 94.74 (Group Rs. 98.17).

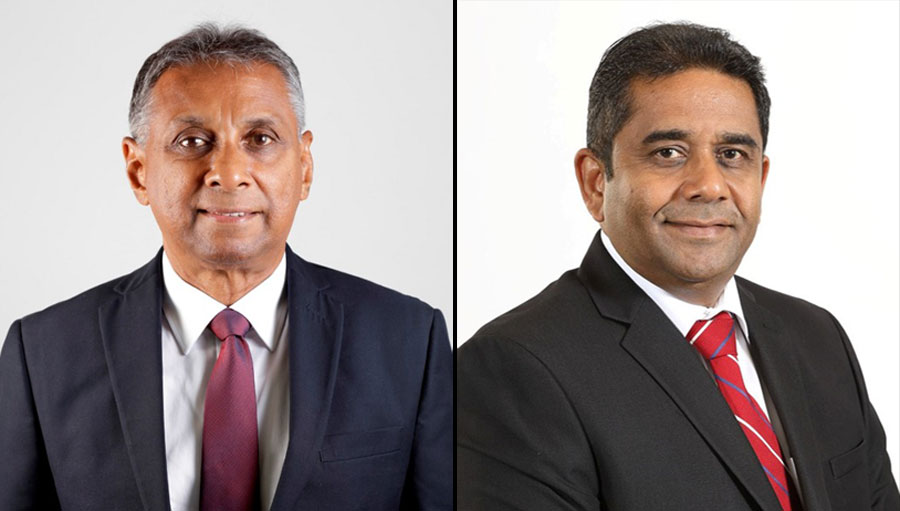

Image Caption Ravi Dias Chairman of Seylan Bank left Kapila Ariyaratne - Director CEO of Seylan Bank right