This year, the bank extended the benefits to minor account savers holding foreign currency accounts.

Commencing from March 15 to April 29, 2022, HNB will offer an array of benefits for all HNB Singithi account holders below the age of 16.

“We are pleased to announce that HNB will continue its ‘Singithi Jumbo Avurudu’ campaign once again this year.

Given the challenging times we believe it is now more important than ever to ensure our minor savers are financially independent and build a strong financial foundation for their future.

“With this in mind, we extended the exciting offers to our minor savers holding foreign currency accounts this year encouraging non-resident Sri Lankans to open foreign currency savings accounts for their children.

We hope this will help stamp a culture where young minds today can save for their future and be rewarded for it,” HNB Head of Deposits, Viranga Gamage states.

The campaign offers minors exciting gifts and attractive vouchers to rupee accounts for fresh deposits of Rs.5,000 to Rs.1,000,000 and foreign currency savings accounts for fresh deposits of $50 to $5,000 or its equivalent in any other foreign currency.

Accordingly, account holders depositing Rs. 500,000 will receive a Rs. 25,000 voucher, and for deposits of Rs.1,000,000 will receive vouchers of Rs. 50,000, which can be used to make purchases at selected merchant outlets.

The Bank also facilitates the account holders to redeposit these vouchers back into their savings account if they choose to do so.

HNB also extends these exciting offer to new ‘Singithi’ account opened during the campaign period and will offer customers vouchers in addition to gifts such as pen holders, umbrellas and bags.

“We at HNB are excited to help take this generation forward. We believe that financial literacy, financial independency and the culture of savings must be embedded in children from a very young age.

We actively reach out to schools and other educational institutions to help us inculcate this ideology.

Due to the pandemic, we had to temporarily put our school-banking units on hold, but we are now looking at reactivating them and we are discussing initiatives to bring about deposit mobilization initiatives as well.

We look forward to bringing in a new generation who grow with HNB, and we will gladly show them the road to smart savings for a steady future.” adds Viranga Gamage.

Since the inception of the Singithi account, HNB has embarked on numerous initiatives to encourage a savings habit among the students by linking consistent savings to tangible rewards for the youth.

Along this vein, the Diru Daru scholarship programme was introduced to provide Singithi savers who passed the Grade 5 scholarship examination with cash prizes.

The largest fund of its kind offered by any Sri Lankan bank, Diru Daru was also extended to GCE and London O/L and A/L students with Singithi accounts if account balances are maintained within a certain threshold.

Further information regarding the offer can be obtained from HNB Branches island-wide.

With 256 customer centres across the country, HNB is one of Sri Lanka’s largest, most technologically innovative banks, having won local and global recognition for its efforts to drive forward a new paradigm in digital banking.

Consolidating its reputation for banking excellence, HNB bagged the Best Retail Bank and Best SME Bank awards in the Banking category at the International Finance Awards 2021.

The bank was also ranked among the World Top 1,000 Banks list compiled by the prestigious UK-based Banker Magazine for five consecutive years.

HNB was also declared Best Sub-Custodian Bank in Sri Lanka at the Global Finance Awards 2020.

HNB has a national rating of AA- (lka) by Fitch Ratings (Lanka) Ltd.

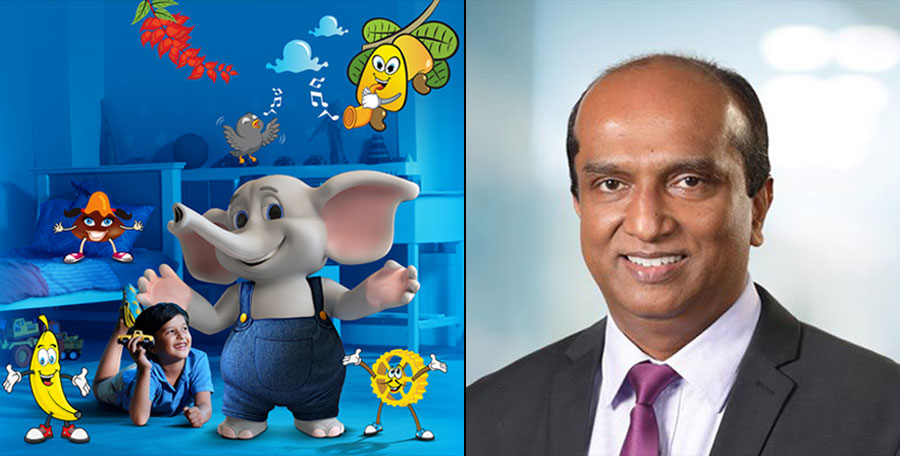

Photo Captions HNB Head of Deposits Viranga Gamage.