The significant milestone makes Softlogic Life the youngest life insurer to achieve this remarkable feat.

During the six months ending 30th June 2022, Softlogic Life has posted a Gross Written Premium (GWP) of Rs. 11.4 Bn with an increase in top-line growth of 24% vs. an overall industry growth of 18.7% compared to last year.

The market share of 17.1% recorded as at 30th June 2022 now ranks Softlogic Life as the second largest in the life insurance market, overtaking industry heavyweights who have been prevalent for many decades in comparison.

Since its inception, Softlogic Life has been striving to improve the quality of life of Sri Lankans through relevant disruptive innovations and digitalization.

Industry-first innovations such as one-day automated claims settlement, 1-minute hospitalization claim settlement, 100% digitalized sales platform, automatic policy issuance and mobile-based micro products has helped the company to deliver a superior customer experience, which has been instrumental in enhancing its competitive position.

But the biggest reason of them all that enabled the company to grow amidst calamity was because the company stood firmly with over 1.5Mn customers in a business landscape disrupted by the pandemic and a full-blown economic crisis, becoming the largest COVID claims settler with over Rs 1.4 billion Covid-19 claims being paid whilst also attracting more than 17% of the new business in the industry during the period in review.

Recognizing this phenomenal growth story year on year is why the company was also titled the “Best life Insurance Company of the Year” at Emerging Asia Awards 2021 and the only brand to have won “Brand of the Year” for two consecutive years at Effie awards - 2019/2021.

In addition, as a result of the company’s firm commitment towards ensuring high standards in transparency and Corporate Governance, Softlogic Life was awarded an overall Silver across industries for excellence in Financial reporting and a Gold Award in the insurance sector at Annual report awards 2021 organised by Institute of Chartered Accountants of Sri Lanka while also winning an Overall Gold at the CMA Excellence in Integrating Reporting Awards 2021.

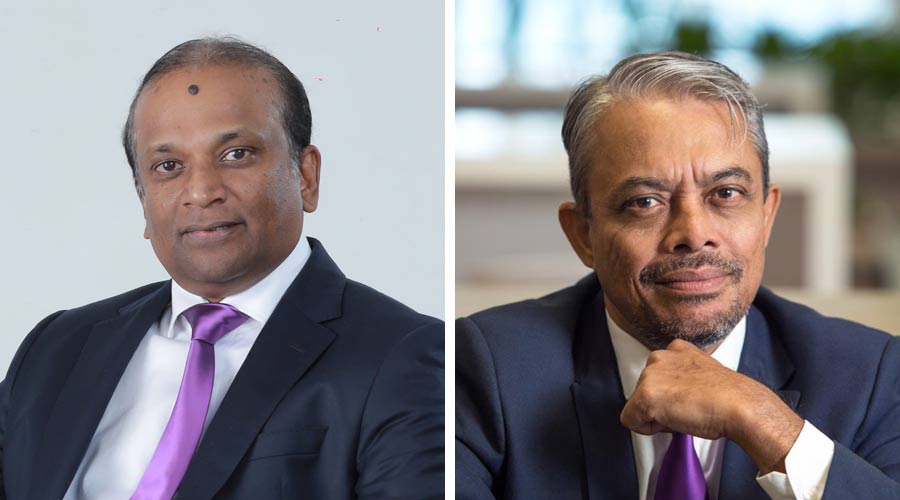

Commenting on the milestone, Ashok Pathirage, Chairman of Softlogic Life Insurance PLC, stated,

“I am truly proud of this achievement by Softlogic Life.

Driven by bold leadership, an inspired team with a “Can Do” attitude and a vibrant strategy for continuous improvement, the company always believes in defying the odds.

Today they have done just that by moving towards the pinnacle to become Sri Lanka’s 2nd largest life insurance company.

This drive is why global investors have chosen Softlogic Life to invest in and continue to provide invaluable support towards growing our business in all aspects.

I’m extremely pleased to see, how Softlogic Life “a company we took under the wings of “Softlogic Group” in 2011 has grown by leaps and bounds whilst also transforming the industry.

Iftikar Ahamed, Managing Director of Softlogic Life PLC, commented,

“As a young company we have achieved something phenomenal crafting and delivering a winning strategy that is the hallmark of the Softlogic Group in just eight years.

It is a historical milestone to achieve the number two spot in an extremely competitive, mature sector that was for years lead by decade old industry giants.

The top and bottom-line performances during the first half of 2022 show optimism and confidence in continuing to improve our business and delivering great value to our policy holders and stakeholders, even amidst challenging macroeconomic conditions.

I would like to thank the management team, employees and our sales force for their hard work and commitment to make this vision a reality.

I’d also like to thank our customers and all other stakeholders of Softlogic Life for their unwavering trust in us”

Along with it’s phenomenal growth momentum, the company has also been resolute in-terms of its financial stability and the overall health of the organization.

In the period of review, the company’s Profit After Tax (PAT) rose to Rs. 1.2 Bn with a 30% growth. Profit before tax (PBT) rose to Rs.1.7 Bn with a 14% growth compared to last year.

Furthermore, Softlogic Life maintained a healthy Capital Adequacy Ratio (CAR) of 325%, well above the regulatory CAR requirement of 120%.

All of this, while maintaining a 10-year Compound Annual Growth Rate (CAGR) of 29% in GWP against an industry CAGR of 14.3%.

A life insurance company that was seen by people as the fastest-growing life insurance company with the best momentum in the industry is now starting to be seen in a different light.

Today Softlogic Life is seen as “The Industry Benchmark” that has set the pace and buzz in the world of life insurance for its innovative, daring, consistent and remarkable growth story amidst a calamity.

Photo Caption Left to Right Ashok Pathirage, Chairman of Softlogic Life Insurance PLC and Iftikar Ahamed, Managing Director of Softlogic Life Insurance PLC