With investment and other income of Rs 15.129 billion for the year, the Company ended 2021 with consolidated income of Rs 40.694 billion, an improvement of 10 per cent over 2020.

Ceylinco Life’s investment portfolio grew by Rs 20.748 billion or 15.52 per cent over the 12 months to Rs 154.455 billion at the end of the year.

The Company’s Life Fund grew by 12 per cent to Rs 119.634 as at 31st December 2021, consequent to a transfer of Rs 11.803 billion, which was 25 per cent higher than the transfer made in respect of 2020.

Total assets grew by Rs 22.9 billion or 15.23 per cent over the year at a monthly average of more than Rs 1.9 billion to reach Rs 173.762 billion at the end of the year reviewed.

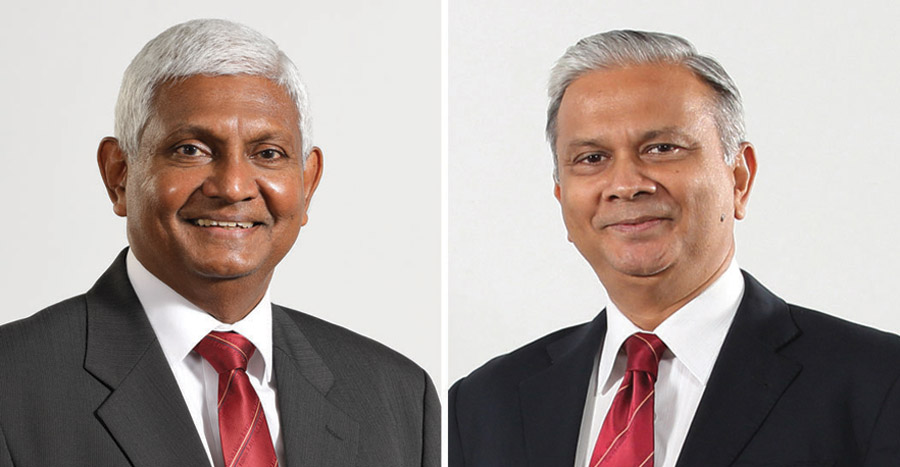

Commenting on the company’s performance in what he described as a year of snowballing challenges, Ceylinco Life Managing Director/CEO Mr Thushara Ranasinghe said:

“Our figures for 2021 demonstrate the importance of not allowing external factors to distract us from our fundamental purpose, which is to de-risk the future for more and more Sri Lankans through life insurance.

The pressures of economic uncertainty and mercurial policies did pose a challenge to most businesses in 2021, but Ceylinco Life maintained its growth momentum by focusing on the evolving needs and concerns of its customer base.”

The Company paid Rs 12.736 billion in net claims and benefits to policyholders for the year under review, an increase of 3.8 per cent over the preceding year, and transferred Rs 4.5 billion to the shareholders fund, which stood at Rs 44.194 billion at the end of 2021.

Ceylinco Life’s basic earnings per share for the year amounted to Rs 137, while net assets value per share stood at Rs 883.88 as at 31st December 2021, an increase of 15.8 per cent.

Among the highlights of the year reviewed was the launch of two ground-breaking market responsive new products – ‘Future Saver’ and ‘Education Protector.’

Future Saver is a new paradigm life insurance product that offers protection as well as wealth accumulation, with an emphasis on the latter. It is designed to enable policyholders to plan for long-term goals by passionately saving for a short period during which their financial stability is at its peak.

Education Protector is an insurance plan designed exclusively for the purpose of ensuring the continued education of children.

It enables a parent to, with just a single one-time premium payment, secure the future education prospects of a child in the event of his or her inability to do so due to death or total and permanent disability.

Adjudged Sri Lanka’s Service Brand of the Year by the Sri Lanka Institute of Marketing (SLIM) and voted the ‘Most Popular Service Provider’ in Sri Lanka’s Life Insurance industry in 2021, Ceylinco Life has been the country’s leading life insurer for more than half of the 33 years it has been in existence.

The company was ranked the ‘Most Valuable Life Insurance Brand’ in Sri Lanka by Brand Finance also in 2021, during which it was also named one of the 10 Most Admired Companies in Sri Lanka by the International Chamber of Commerce Sri Lanka (ICCSL) in collaboration with the Chartered Institute of Management Accountants (CIMA), was voted the ‘Peoples Life Insurance Service Provider of the Year’ for a record 15th consecutive year, was certified as a ‘Great Workplace’ in Sri Lanka by Great Place to Work® and was named the ‘Best Life Insurer in Sri Lanka’ for the eighth consecutive year by World Finance.

Ceylinco Life has close to a million lives covered by active policies and is acknowledged as a benchmark in the local insurance sector for innovation, product research and development, customer service, professional development, sustainability, and corporate social responsibility.