The sharp reduction of construction activities since the start of 2023 has pushed the industry into near collapse, a fate the key industry players think is made more inevitable with the anticipated exponential rise of operational costs, following the introduction of VAT in January 2024.

Despite the forecasted growth in demand, Sri Lanka's cement industry not only fell short but contracted even more rapidly than expected in the face of the post-pandemic economic decline.

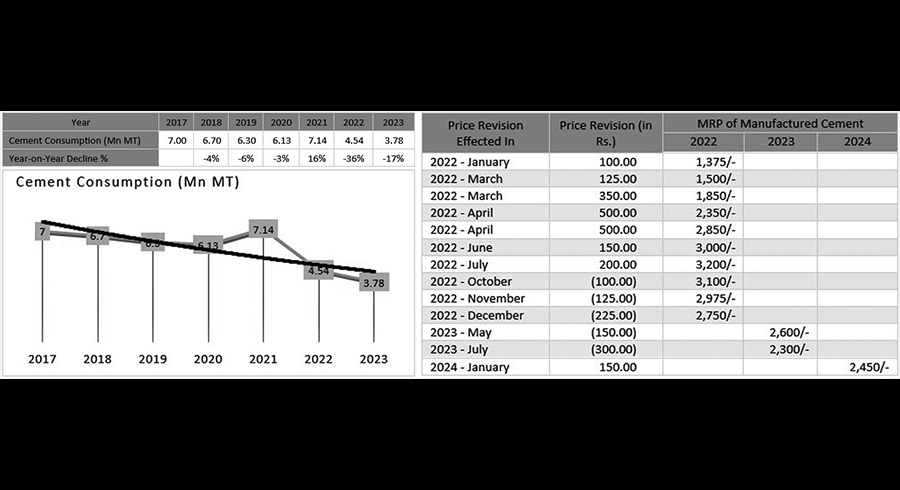

Apart from the 16% increase in 2021 which came from import restrictions due to wider forex illiquidity, cement consumption has continuously moved on a downward trajectory since 2017.

The cement market continued to lose momentum with a 17% decline recorded in 2023, on the heels of a substantial 36% negative growth in 2022, compounding the industry stagnation as the country struggles to rebound from the ensuing financial crisis.

With the onset of the pandemic-related economic slowdown the Maximum Retail Price (MRP) of cement, which remained stable for a long time, was revised frequently, with significant fluctuations taking place in 2022.

However, as the economy started showing signs of relative stability in 2023, cement manufacturers promptly passed on the cost benefit to the consumers as and when they occurred.

In this backdrop, the market shrinkage further intensified as the disposable income of consumers got restricted with the increment of income taxes and sharp increases in utility prices.

Furthermore, the almost doubling of contractor fees and labour costs discouraged construction activities in the residential sector.

Optimism of a more stable cost environment for businesses as the Rupee stabilized against the US Dollar was short lived, due to several tax increases.

In addition to an increase in corporate taxes, a CESS was imposed on the importation of raw materials.

The escalation of costs is further intensified by the high lending rates, which caused most construction projects to halt ongoing work whilst others postponed the commencement of new projects in both residential and commercial sectors.

In this backdrop, the VAT percentage increase coupled with the expansion of the VAT liable goods and services list will raise fuel and transport costs, to further increase the cost of operations for manufacturers.

This sharp increase negates any price benefits that were passed on to the consumers previously.

This situation severely threatens business continuity of local cement manufacturers who are struggling to survive whilst being unable to recover extensive investments on business development.

Over the past several years, cement manufacturers have invested heavily in capacity expansion to meet the expected growth in consumer demand.

An unfavorable market impacts all players in the industry.

When the permeation of revenue and profits generated by local manufacturers through their vast value chains gets restricted in a contracting market, the overall economic recovery of the country is bound to slow down.

Whilst some of these decisions are required to overcome the current economic crisis, it is imperative that the policy decisions are made in consideration of the long-term and overall impact on all the players of the national economy.