This hard work is attested to by the global recognition that DFCC Bank received from Global Brands UK, being recognised as both the ‘Most Trusted Retail Banking Brand’ and the ‘Best Customer Service Banking Brand’ in Sri Lanka for 2021, in the ‘’Banking and Finance” category.

With the objective of becoming one of Sri Lanka's most customer-centric digitally enabled banks by 2025, and in line with the Bank’s corporate strategy, the T24 Temenos Core Banking System was implemented on 21 October 2021, along with a functionally rich online banking platform.

The transition to the new core banking system will offer customers a digitally enabled, best in class banking service that is flexible and agile.

The Bank was able to achieve expected growth as a result of executing a focussed strategy, driven by its purpose.

The core objective being to help people and businesses prosper by embracing change through technological transformation, in order to continue to seize new opportunities resulting from the challenges of the pandemic.

The Bank implemented several concessionary schemes to support customers affected by the pandemic, helping them to emerge stronger, through numerous moratoriums, relief measures and advisory support and services, in accordance with the directives issued by the Central Bank of Sri Lanka.

As a result of this focussed approach and agile manoeuvring, DFCC Bank was able to successfully conclude the year ended 31 December 2021, having delivered robust performance and growth, amidst a challenging economic environment.

Thus, the following commentary relates to the audited Financial Statements for the year ended 31 December 2021, and is presented in accordance with Sri Lanka Accounting Standard 34 (LKAS 34) on “Interim Financial Statements”.

Financial Performance Profitability

The DFCC Group comprises of DFCC Bank PLC (DFCC), and its subsidiaries – Lanka Industrial Estates Limited (LINDEL), DFCC Consulting (Pvt) Limited (DCPL) and Synapsys Limited (SL), the joint venture company – Acuity Partners (Pvt) Limited (APL) and associate company – National Asset Management Limited (NAMAL).

DFCC Bank PLC, the largest entity within the Group, reported a profit before tax (PBT) of LKR 4,326Mn and a profit after tax (PAT) of LKR 3,222 Mn for the year ended 31 December 2021.

This compares with a PBT of LKR 3,398 Mn and a PAT of LKR 2,388 Mn in the year prior.

The Group recorded a PBT of LKR 4,859 Mn and a PAT of LKR 3,665Mn for the year ended 31 December 2021, compared with LKR 3,944 Mn and LKR 2,847 Mn, respectively, in 2020.

All the member entities of the Group made positive contributions to this performance.

The basic earnings per ordinary share (EPS) of the Bank improved to LKR 10.14 for the year ended 31 December 2021 from LKR 7.83 for the comparative year 2020, recording an increase of 29%.

The Bank’s Return on Equity (ROE) improved to 6.55% during the year ended 31 December 2021 from 4.93% recorded for the year ended 31 December 2020.

The Bank’s Return on Assets (ROA) before tax for the year ended 31 December 2021 is 0.91%, against a figure of0.78% for the year ended 31 December 2020.

Net Interest Income

The Bank recorded LKR 12,653 Mn in net interest income (NII), which is a 15% increase year on year.

This contributed to an increase in interest margin from 2.53% in December 2020 to 2.66% in December 2021.

Other Operating Income

Due to travel restrictions imposed during the year to curb the spread of the pandemic, business momentum was noticeably negatively affected.

The Bank staff at Head office and across branch network working continuously over the year has helped the Bank to increase non-funded business.

This effort was fruitful as it resulted in an increase in net fee and commission income to LKR 2,596 Mn for the year ended 31 December 2021, up from LKR 2,061 Mn in the comparative year.

Other operating income has increased mainly due to increases in dividend income and gains on the sale of fixed income securities during the year ended 31 December 2021.

Impairment Charge on Loans and Other Losses

Impairment provisions for the year ended 31December 2021 was LKR 4,485 Mn compared to LKR 3,298 Mn in the year prior.

The NPL ratio increased from 5.56% in December 2020 to 5.60% in December 2021.

In order to address the current and potential future impacts of Covid-19 and other prevailing economic conditions on the lending portfolio, the bank has made adequate impairment provisions, as at 31 December 2021, by introducing changes to internal models to cover unseen risk factors in the present highly uncertain and volatile environment, including additional provisions made for the Bank’s exposure to risk elevated sectors.

Operating Expenses

The Bank’s operating expenses increased from LKR 7,387 million during the year prior to LKR 8,381 million during the year under review, primarily due to increases in transport costs, as result of special transport facilities provided to staff due to covid restrictions and non-availability of public transport, along with all other additional expenses incurred in keeping and maintaining a safe and healthy environment within the Bank’s premises, to support client engagements and servicing.

During the year, the Bank also created multiple channels to enhance service delivery to customers through a strong digital drive, providing access to uninterrupted banking services during difficult times.

This resulted in an increase in IT related expenses in order to support the infrastructure upgrades.

However, the numerous process automation and workflow management systems introduced during the year under review helped to facilitate effective cost controls, which resulted in operating expenses being curtailed and managed at these levels.

Other Comprehensive Income

Investments in equity securities and treasury bills and bonds (fixed income securities) are classified as financial assets and their change in fair value is recorded through other comprehensive income.

Accordingly, a fair value loss of LKR 36Mn and a net fair value loss of LKR 2,469Mn were recorded on account of equity and fixed income securities, outstanding as at 31 December 2021 respectively.

Unfavourable movements in Treasury bill and bond yields resulted in the fair value loss of LKR 4,532 Mn during the year.

A gain of LKR 2,062 Mn was recycled through the Income statement by disposing of selected Treasury bill and bond holdings, originally categorized under fair value through other comprehensive income (FVOCI), with the objective of cash flow management to support loans and advance growth in line with projections.

The action also goes in tandem with the bank’s expectations with regard to the domestic interest rate trend, going forward.

Business Growth

Despite the challenging business environment, the Bank continued its growth strategy by increasing both its deposit and loan portfolios during the year ended 31 December 2021.

The loan portfolio grew by LKR 63,991 Mn to record LKR 365,901 Mn compared to LKR 301,909 Mn as at 31 December 2020, recording an increase of 21%.

The Bank’s deposit base also experienced a growth of 3%, recording an increase of LKR 9,834 Mn to LKR 319,861 Mn from LKR 310,027 Mn as at 31 December 2020.

This resulted in recording a loan to deposit ratio of 114%.

Further CASA ratio improved to 31.25% as at 31 December 2021.

Funding costs of the Bank were also contained by using medium to long-term concessionary credit lines.

When these concessionary term borrowings are considered, the CASA ratio further improved to 36.47% as at 31 December 2021.

DFCC Bank continued its approach to tap local and foreign currency related long to medium- term borrowing opportunities to facilitate lending to deserving segments of the market whilst maintaining a high-quality portfolio.

Equity and Compliance with Capital Requirements

In order to support future growth as a full-service retail bank, the Bank has consistently maintained a capital ratio above the Basel III minimum capital requirements.

As at 31 December 2021, the Bank has recorded Tier 1 and total capital adequacy ratios of 9.31% and 13.03%, respectively which is comfortably above the minimum regulatory requirements of 8% and 12% including capital conservation buffer of 2%.

The Bank’s Net Stable Funding Ratio was 122.43%, which is well above the regulatory minimum of 100%.

CEO Comment

“Ensuring that we run our business responsibly, delivering profit with purpose, DFCC Bank will always place our customers at the forefront of everything we do.

As a customer centric, digitally enabled bank, we will continue to be a source of stability to our customers and deliver value through an unmatched, top-of-the-line customer experience.

In line with our stated vision, the Bank embarked upon implementing a state of the art, core banking system which went live in October 2021.

Considering the magnitude and complexity of the implementation, we have had to face some unforeseen challenge and I take this opportunity to express our sincere thanks and gratitude to all our clients, who have been understanding and patient with us this year, as we continuously strive to ensure a more futuristic, digitally-enabled system for our clients.

Despite the unprecedented challenges faced due to the ongoing pandemic, staff of DFCC Bank have and will continue to work with commitment to combat the negative socio-economic effects that have impacted our customers and assist them through tailor made financial solutions.

We will continue to introduce banking services that put safety and security at the forefront and ensure that our internal processes are aligned with these same principles to serve our customers better.

We have a strong asset base to be deployed, but nothing is more important than the loyalty we earn from customers, not just by keeping their money and their data safe, but by offering products and services that meet their financial needs and requirements.

This loyalty generates both more predictable returns and keen insights, enabling us to continuously improve our services and exceed customer expectations.”

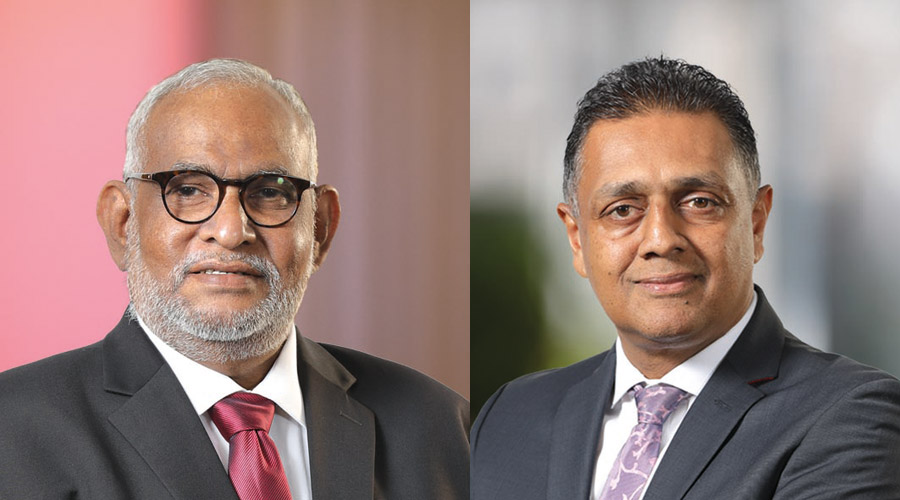

Image Caption Left to Right DFCC Bank Chairman J. Durairatnam and DFCC Bank Director CEO Thimal Perera