Receipts will all be digital, making expense claims almost instantaneous. Cash will all be on pre-paid cards, or apps, and credit and debit cards will have all gone electronic. Everything will be done from our smartphones.

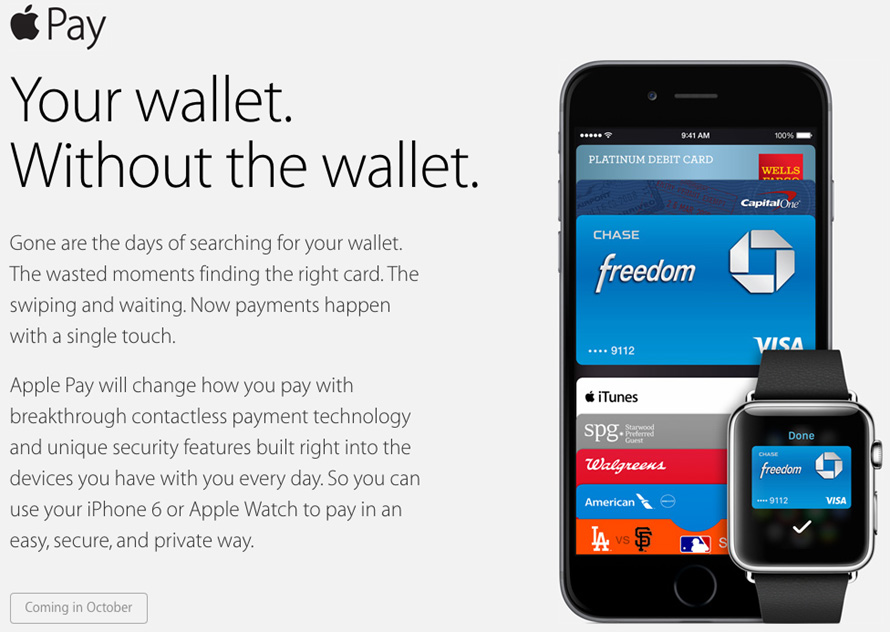

That this is an easy prediction to make is down to one startling innovation launched on Monday. Apple Pay is not only set to revolutionise how we pay, but it is also set to radically change mobile commerce. Though Apple’s transaction cost won’t make it a lot of money, it will reinforce its position as one of only two credible smartphone OS choices. When the billionaire investor Carl Icann said Apple shares could double, he may not be far from the truth.

So why will Apple lead the way where others have failed? There are three answers: serendipity, technology and the Apple ecosystem.

Usually the biggest impediment to the roll out of technology of this kind is the infrastructure change needed at point of sale. It’s one reason why QR code vouchers with Passbook didn’t take off – most retailers were still stuck with one-dimensional barcode readers.

Apple, however, has managed to take advantage of a peculiar quirk of the US payment system. Whilst the rest of the world has upgraded to Chip and Pin cards, the US is only just starting to catch on. Most retailers there have, until recently, relied on the swipe technology of yesteryear, which of course is incredibly susceptible to fraud.

Into this massive upgrade cycle on the retailer’s debit/credit card payment technology steps Apple. If you’re going to install Chip and Pin you may as well install contactless. Which is why Apple can persuade 39 retailers to accept its payment by the year’s end.

For once Tim Cook’s hyperbole could be right when he says ‘Apple Pay is going to be huge’. Like the iPhone before it, which leapfrogged European mobile technology, Apple Pay will leapfrog Chip and Pin in the States. Success may be harder to come by in more advanced European markets and, interestingly, Apple Pay will launch in Asia before it crosses the Atlantic.

There are two other weapons in Apple’s armoury, though, which will make it a strong player in all markets.

From a technology perspective, Apple has resisted putting NFC in its smartphones for some time now, and there are other phones which have come to market with it before the iPhone. There were plenty of MP3 players before the iPod too. Apple is all about creating the best possible experience, and a little overlooked feature of the iPhone 6 is that the NFC is optimised to ensure a near perfect experience. (Curiously, the iPhone 6 has 2 NFC chips).

The biggest factor of all, though, which will contribute to the success of Apple Pay, is its ecosystem. Apple Pay not only allows the user to buy goods and services in stores, but it also can be used on your device. Up until now, mobile commerce on smartphones was small compared to the iPad. That is all set to change. Smartphone payments are set to soar.

Imagine buying your airline tickets on your phone and just having to tap to pay without all that hassle of entering in your credit card details. With payment that easy, the only thing to figure out is how to watch your spending – something that hasn’t been missed by the credit card companies. Research by MasterCard suggests that contactless payment increases spend on cards by 30 per cent. With figures like that, it’s little wonder the six biggest card issuers, accounting for roughly 83 per cent of credit-card transactions, have signed up to Apple Pay.

And then there is Passbook, where your cards for Apple Pay will be stored. Overlooked at launch two years ago, Passbook is set to become every credit card company and bankcard issuer’s customer relationship dream. This is because Passbook is designed so that it can be easily connected to a card issuer’s database, allowing them to serve up notice of new offers, and payment reminders, straight to your notification screen.

What Apple has envisioned is a true replacement to the wallet. It will place the smartphone firmly as the most important device we own, and will ensure Apple sells many more of these devices in the future. By linking Apple Pay to the Apple Watch, waving your hand past an NFC reader will become a natural habit for many of us. Apple Pay’s day has arrived.